General Electric Co (GE)

Summary

GE Chart

GE Aerospace: Q1 Earnings, A Buy On The Dip

GE Aerospace's Q1 2025 earnings surged with a 60% rise in adjusted EPS and 11% YoY sales growth, driven by strong demand for aircraft engines. The Commercial Engines & Services division, contributing 75% of sales, saw a 35% YoY increase in operating profits, reflecting robust travel industry projections. Despite a recent stock pullback, the favorable aerospace market conditions present a buying opportunity, with potential for significant operating profit growth.

GE Aerospace a ‘sanctuary stock' in tariff tidal wave, analysts believe

GE Aerospace (NYSE:GE) has reaffirmed its 2025 outlook despite a $500 million tariff-related cost headwind, prompting analysts at Bank of America to raise their price objective on the stock to $230 from $225 and reiterate a ‘Buy' rating. Describing GE as “the sanctuary stock,” analysts wrote: “While other companies appear to be caught in a tariff tidal wave, GE's proactive tariff mitigation strategy, market positioning, and operational strength have insulated them, in our view.

General Electric Company (GE) Q1 2025 Earnings Call Transcript

General Electric Company (NYSE:GE ) Q1 2025 Earnings Conference Call April 22, 2025 7:30 AM ET Company Participants Blaire Shoor - Investor Relations Larry Culp - Chairman and Chief Executive Officer Rahul Ghai - Chief Financial Officer Conference Call Participants Douglas Harned - Bernstein Sheila Kahyaoglu - Jefferies David Strauss - Barclays Gautam Khanna - TD Cowen Ken Herbert - RBC Capital Markets Myles Walton - Wolfe Research Noah Poponak - Goldman Sachs Scott Deuschle - Deutsche Bank Seth Seifman - JPMorgan Jason Gursky - Citi Ron Epstein - Bank of America Scott Mikus - Melius Research Operator Good day, ladies and gentlemen, and welcome to the GE Aerospace First Quarter 2025 Earnings Conference Call. At this time, all participants are in a listen-only mode.

General Electric Co Dividends

GE In 1 month Estimated | Quarterly | $0.36 Per Share |

GE 1 month ago Paid | Quarterly | $0.36 Per Share |

GE 4 months ago Paid | Quarterly | $0.28 Per Share |

GE 7 months ago Paid | Quarterly | $0.28 Per Share |

GE 9 months ago Paid | Quarterly | $0.28 Per Share |

GE 12 Apr 2024 Paid | Quarterly | $0.28 Per Share |

General Electric Co Earnings

| 21 Apr 2025 Date | | - Cons. EPS | - EPS |

| 21 Jan 2025 Date | | 1.05 Cons. EPS | 1.32 EPS |

| 22 Oct 2024 Date | | 1.14 Cons. EPS | 1.15 EPS |

| 23 Jul 2024 Date | | 0.99 Cons. EPS | 1.2 EPS |

| 7 May 2024 Date | | 0.66 Cons. EPS | 0.82 EPS |

GE In 1 month Estimated | Quarterly | $0.36 Per Share |

GE 1 month ago Paid | Quarterly | $0.36 Per Share |

GE 4 months ago Paid | Quarterly | $0.28 Per Share |

GE 7 months ago Paid | Quarterly | $0.28 Per Share |

GE 9 months ago Paid | Quarterly | $0.28 Per Share |

GE 12 Apr 2024 Paid | Quarterly | $0.28 Per Share |

| 21 Apr 2025 Date | | - Cons. EPS | - EPS |

| 21 Jan 2025 Date | | 1.05 Cons. EPS | 1.32 EPS |

| 22 Oct 2024 Date | | 1.14 Cons. EPS | 1.15 EPS |

| 23 Jul 2024 Date | | 0.99 Cons. EPS | 1.2 EPS |

| 7 May 2024 Date | | 0.66 Cons. EPS | 0.82 EPS |

General Electric Co (GE) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

Has General Electric Co ever had a stock split?

General Electric Co Profile

| Aerospace & Defense Industry | Industrials Sector | Mr. H. Lawrence Culp Jr. CEO | NYSE Exchange | US3696043013 ISIN |

| United States Country | 125,000 Employees | 10 Mar 2025 Last Dividend | 2 Apr 2024 Last Split | - IPO Date |

Overview

General Electric Company, known by its trade name GE Aerospace, is a prestigious entity engaged in the design and manufacture of a wide array of products and services tailored for commercial and defense applications. These include aircraft engines, integrated engine components, alongside electric power and mechanical systems for aircraft. In addition to its impressive portfolio of products, GE Aerospace extends aftermarket services to ensure the longevity and efficiency of its offerings. The company exhibits a broad operational footprint, with activities spanning across vital regions including the United States, Europe, China, Asia, the Americas, the Middle East, and Africa. Having been established in 1892, GE Aerospace has its headquarters situated in Evendale, Ohio, marking its presence as a longstanding and pivotal player in the aerospace and defense sectors.

Products and Services

-

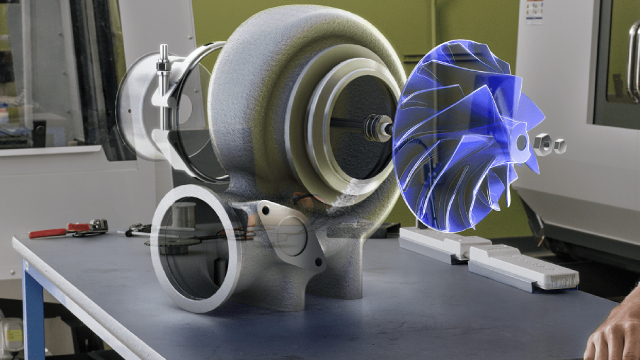

Commercial and Defense Aircraft Engines

GE Aerospace leverages its advanced technological capabilities to design and produce a comprehensive range of engines for both commercial airliners and military defense aircraft. These engines are renowned for their reliability, efficiency, and performance, catering to the diverse needs of the global aviation industry.

-

Integrated Engine Components

In addition to complete engines, the company specializes in the production of integral engine components. These components are engineered to meet the highest standards of quality and performance, ensuring optimal functionality and compatibility with a wide variety of aircraft engines.

-

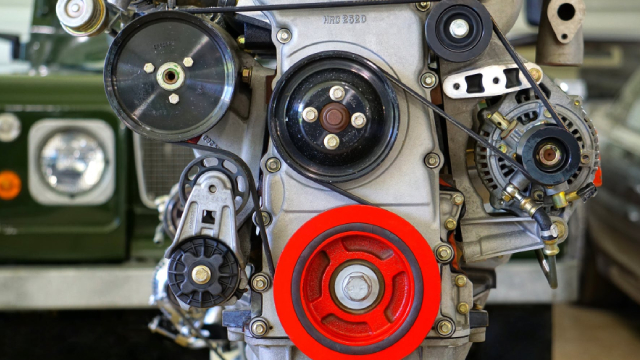

Electric Power and Mechanical Aircraft Systems

GE Aerospace's expertise extends beyond engines, encompassing the development of complex electric power and mechanical systems for aircraft. These systems play crucial roles in the overall performance and safety of both commercial and military aircraft, embodying the innovative spirit of GE Aerospace.

-

Aftermarket Services

Understanding the importance of maintenance and support, GE Aerospace offers an extensive range of aftermarket services. These services are designed to ensure the ongoing operational efficiency and reliability of its products, offering clients peace of mind and reduced lifecycle costs.