L3Harris Technologies Inc (LHX)

Summary

LHX Chart

L3Harris Technologies: A Steady Course In A Changing World

L3Harris Technologies, a major defense contractor, has a strong order backlog of $34 billion and expects a revenue boost from expanding space and aviation programs. The company's flexible business model and strategic acquisitions, like Aerojet Rocketdyne, position it well in niche markets such as tactical communications and electronic warfare. Despite high competition and dependence on the US defense budget, L3Harris shows strong financials, with a 2024 net income of $1.502 billion and a 7% net margin.

L3Harris to Present at Three Upcoming Investor Conferences

MELBOURNE, Fla.--(BUSINESS WIRE)--L3Harris Technologies (NYSE: LHX) Chief Financial Officer and Aerojet Rocketdyne President Ken Bedingfield will present at Barclays Americas Select Franchise Conference in London at 8:30 a.m. local (3:30 a.m. ET) on Tuesday, May 6. The presentation will stream live on the L3Harris website, with a recording available after the event. Bedingfield will also present at the Wolfe Research Conference at 12:50 p.m. ET on Thursday, May 22, in New York City. The present.

L3Harris Technologies, Inc. (LHX) Q1 2025 Earnings Call Transcript

L3Harris Technologies, Inc. (NYSE:LHX ) Q1 2025 Earnings Conference Call April 24, 2025 10:30 AM ET Company Participants Dan Gittsovich – Vice President-Investor Relations Chris Kubasik – Chair and Chief Executive Officer Ken Bedingfield – Senior Vice President, Chief Financial Officer and President-Aerojet Rocketdyne Conference Call Participants Seth Seifman – J.P. Morgan Ronald Epstein – Bank of America Doug Harned – Bernstein Sheila Kahyaoglu – Jefferies Matt Akers – Wells Fargo Noah Poponak – Goldman Sachs Robert Stallard – Vertical Research Partners Myles Walton – Wolfe Research Jason Gursky – Citigroup Michael Ciarmoli – Truist Securities Peter Arment - Baird Operator Greetings.

L3Harris Technologies Inc Dividends

LHX In 1 month Announced | Quarterly | $1.2 Per Share |

LHX 1 month ago Paid | Quarterly | $1.2 Per Share |

LHX 5 months ago Paid | Quarterly | $1.16 Per Share |

LHX 7 months ago Paid | Quarterly | $1.16 Per Share |

LHX 10 months ago Paid | Quarterly | $1.16 Per Share |

L3Harris Technologies Inc Earnings

| 23 Apr 2025 Date | | - Cons. EPS | - EPS |

| 23 Jan 2025 Date | | 3.44 Cons. EPS | 3.47 EPS |

| 24 Oct 2024 Date | | 3.26 Cons. EPS | 3.34 EPS |

| 25 Jul 2024 Date | | 3.18 Cons. EPS | 3.24 EPS |

| 24 Jul 2024 Date | | 3.14 Cons. EPS | - EPS |

LHX In 1 month Announced | Quarterly | $1.2 Per Share |

LHX 1 month ago Paid | Quarterly | $1.2 Per Share |

LHX 5 months ago Paid | Quarterly | $1.16 Per Share |

LHX 7 months ago Paid | Quarterly | $1.16 Per Share |

LHX 10 months ago Paid | Quarterly | $1.16 Per Share |

| 23 Apr 2025 Date | | - Cons. EPS | - EPS |

| 23 Jan 2025 Date | | 3.44 Cons. EPS | 3.47 EPS |

| 24 Oct 2024 Date | | 3.26 Cons. EPS | 3.34 EPS |

| 25 Jul 2024 Date | | 3.18 Cons. EPS | 3.24 EPS |

| 24 Jul 2024 Date | | 3.14 Cons. EPS | - EPS |

L3Harris Technologies Inc (LHX) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

Has L3Harris Technologies Inc ever had a stock split?

L3Harris Technologies Inc Profile

| Other Industry | Other Sector | Mr. Christopher E. Kubasik CPA CEO | NYSE Exchange | US5024311095 ISIN |

| DE Country | - Employees | 10 Mar 2025 Last Dividend | 11 May 2009 Last Split | 31 Dec 1981 IPO Date |

Overview

L3Harris Technologies, Inc. is a prominent provider of mission-critical solutions to a global client base that encompasses both government entities and commercial organizations. The company plays a crucial role in developing advanced technology solutions geared towards addressing the complex needs of its clients in various sectors, including defense, space, airborne systems, and communications. Originally established in 1895 and headquartered in Melbourne, Florida, L3Harris Technologies has undergone significant transformations, including a name change from Harris Corporation in June 2019, to better reflect its diversified technology portfolio and strategic focus on innovation and excellence in service provision.

Products and Services

L3Harris Technologies, Inc.'s vast array of products and services is segmented into various categories, each targeting specific customer needs and sectors:

- Integrated Mission Systems: This segment delivers a range of solutions including intelligence, surveillance, and reconnaissance (ISR) systems; passive sensing and targeting technologies; electronic attack capabilities; autonomy solutions; advanced power and communication systems; along with networks and sensors. These products are intricately designed to enhance combat readiness and operational effectiveness across air, land, and sea sectors.

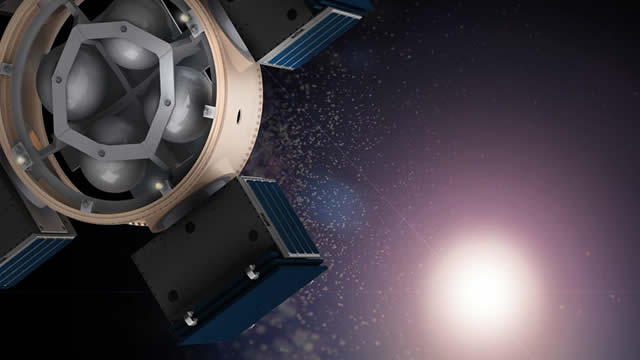

- Space and Airborne Systems: Offering space payloads, sensors, and full-mission solutions, this segment also focuses on classified intelligence, cybersecurity, mission avionics, and electronic warfare systems. Additionally, it provides mission network systems for air traffic management operations, showcasing its wide-ranging capabilities in space and airborne domains.

- Communication Systems: Specializing in broadband communications, this division offers tactical radios and software, satellite terminals, and comprehensive battlefield systems tailored for the U.S. Department of Defense, international, federal, and state agency clientele. It also includes integrated vision solutions such as helmet-mounted night vision goggles, weapon-mounted sights, aiming lasers, and rangefinders, along with public safety radios and equipment for system applications.

- Aerojet Rocketdyne Segment: This part of L3Harris Technologies caters to the defense sector by providing advanced propulsion technologies and armament systems for strategic defense, missile defense, hypersonic, and tactical applications. It also delivers space propulsion and power systems essential for national security, space exploration, and missions, underscoring the company’s pivotal role in supporting defense and exploration initiatives.