The Walt Disney Company (0QZO)

Summary

0QZO Chart

Earnings Preview: Walt Disney (DIS) Q2 Earnings Expected to Decline

Disney (DIS) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Is Disney (DIS) a Buy as Wall Street Analysts Look Optimistic?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Disney: The Compelling Case for Buying Now Before They Scale Up

The Walt Disney Co. NYSE: DIS is the second-largest media and entertainment conglomerate in the world, widely recognized for its portfolio of recognizable brands, iconic intellectual property (IP), and theme parks. The consumer discretionary sector leader has managed to turn its direct-to-consumer (DTC) streaming networks business profitable.

The Walt Disney Company (0QZO) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

What is the earnings per share?

When is the next earnings date?

Has The Walt Disney Company ever had a stock split?

The Walt Disney Company Profile

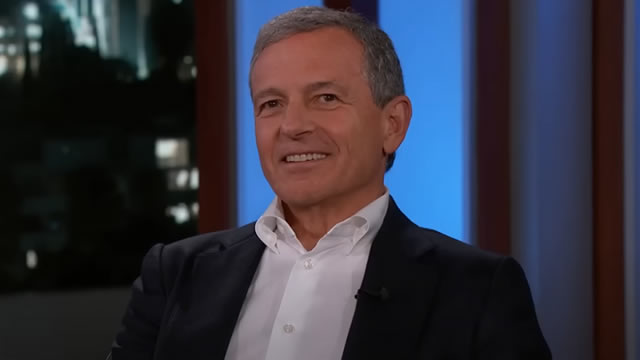

| Entertainment Industry | Communication Services Sector | Mr. Robert A. Iger CEO | LSE Exchange | US2546871060 ISIN |

| United States Country | 173,250 Employees | - Last Dividend | 13 Jun 2007 Last Split | - IPO Date |

Overview

The Walt Disney Company, a pioneer in the entertainment industry, offers a diverse range of entertainment and media services globally. With operations segmented into Entertainment, Sports, and Experiences, Disney has cemented its legacy in producing and distributing a variety of film and television content, as well as offering theme park experiences and consumer products. Founded in 1923 and headquartered in Burbank, California, Disney's influence spans across various media platforms, including streaming services, television networks, and theme parks, showcasing its remarkable ability to evolve with changing industry trends while maintaining its stronghold in entertainment.

Products and Services

- Film and Television Content Production: Disney creates and distributes content under multiple banners such as ABC Television, Disney, FX, and National Geographic among others. This includes original content production through studios like Marvel, Pixar, and Lucasfilm.

- Streaming Services: The company offers direct-to-consumer streaming via Disney+, Disney+ Hotstar, Hulu, and Star+, expanding its reach in the digital content consumption space.

- Sports Entertainment: Through ESPN and related platforms, Disney delivers sports-related content, including live sports broadcasting and original programming.

- Licensing and Distribution: Disney licenses film and episodic content to third-party TV and VOD services, and also handles theatrical, home entertainment, and music distribution.

- Theatrical and Home Entertainment: In addition to traditional theatrical releases, Disney offers DVD, Blu-ray, and electronic home video licenses, plus video-on-demand rental services.

- Live Entertainment and Post-production Services: The company stages live entertainment events and provides post-production services to the entertainment industry.

- Theme Parks and Resorts: Disney operates world-renowned theme parks and resorts, including Walt Disney World, Disneyland Paris, and Shanghai Disney Resort, among others, offering unique experiences based on its rich portfolio of characters and stories.

- Licensing and Merchandising: Licensing its intellectual properties for third-party operations and merchandise, Disney capitalizes on its brand strength across toys, apparel, books, and more.

- Publishing: Disney develops and publishes a wide range of content in the form of books, comic books, and magazines, further broadening its entertainment offerings.