Ame Elite Consortium Berhad (5293)

Summary

5293 Chart

AMETEK, Inc. (AME) Q1 2025 Earnings Call Transcript

AMETEK, Inc. (NYSE:AME ) Q1 2025 Earnings Conference Call May 1, 2025 8:30 AM ET Company Participants Kevin Coleman - Vice President-Investor Relations & Treasurer Dave Zapico - Chairman & Chief Executive Officer Dalip Puri - Executive Vice President & Chief Financial Officer Conference Call Participants Matt Summerville - D.A. Davidson Deane Dray - RBC Capital Markets Jamie Cook - Truist Jeff Sprague - Vertical Research Partners Andrew Obin - Bank of America Brett Linzey - Mizuho Scott Graham - Seaport Research Partners Rob Wertheimer - Melius Research Andrew Buscaglia - BNP Paribas Operator Hello, and welcome to the First Quarter 2025 AMETEK Earnings Conference Call.

AMETEK Q1 Earnings Surpass Expectations, Revenues Decline Y/Y

AME's first-quarter 2025 results reflect the company's declining sales growth in the Electronic Instruments Group segment.

Compared to Estimates, Ametek (AME) Q1 Earnings: A Look at Key Metrics

The headline numbers for Ametek (AME) give insight into how the company performed in the quarter ended March 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Ame Elite Consortium Berhad Dividends

5293 10 months ago | Other | RM0.04 Per Share |

5293 14 Dec 2023 | Other | RM0.02 Per Share |

5293 15 Jun 2023 | Other | RM0.03 Per Share |

5293 12 Oct 2022 | Other | RM0.01 Per Share |

5293 15 Jun 2022 | Other | RM0.03 Per Share |

Ame Elite Consortium Berhad Earnings

| 30 May 2025 (29 Days) Date | | - Cons. EPS | - EPS |

| 26 Feb 2025 Date | | - Cons. EPS | 0.03 EPS |

| 27 Nov 2024 Date | | - Cons. EPS | 0.04 EPS |

| 28 Aug 2024 Date | | - Cons. EPS | 0.02 EPS |

| 29 May 2024 Date | | - Cons. EPS | 0.04 EPS |

5293 10 months ago | Other | RM0.04 Per Share |

5293 14 Dec 2023 | Other | RM0.02 Per Share |

5293 15 Jun 2023 | Other | RM0.03 Per Share |

5293 12 Oct 2022 | Other | RM0.01 Per Share |

5293 15 Jun 2022 | Other | RM0.03 Per Share |

| 30 May 2025 (29 Days) Date | | - Cons. EPS | - EPS |

| 26 Feb 2025 Date | | - Cons. EPS | 0.03 EPS |

| 27 Nov 2024 Date | | - Cons. EPS | 0.04 EPS |

| 28 Aug 2024 Date | | - Cons. EPS | 0.02 EPS |

| 29 May 2024 Date | | - Cons. EPS | 0.04 EPS |

Ame Elite Consortium Berhad (5293) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

What is the earnings per share?

When is the next earnings date?

Has Ame Elite Consortium Berhad ever had a stock split?

Ame Elite Consortium Berhad Profile

| Specialty Industrial Machinery Industry | Industrials Sector | Mr. David A. Zapico CEO | XKLS Exchange | MYL5293OO005 ISIN |

| United States Country | 21,500 Employees | 14 Mar 2025 Last Dividend | 2 Jul 2012 Last Split | 19 Jul 1984 IPO Date |

Overview

AMETEK, Inc., with its inception in 1930, stands as a multinational enterprise headquartered in Berwyn, Pennsylvania, devoted to the production and marketing of electronic instruments and electromechanical devices globally. Its operations span across critical regions, including North America, Europe, Asia, and South America, catering to a broad spectrum of industries through its extensive product offerings. The company's organizational structure is segmented into two key divisions: the Electronic Instruments Group (EIG) and the Electromechanical Group (EMG), each focusing on delivering specialized products and services across various market sectors such as aerospace, power, industrial, medical, and defense.

Products and Services

AMETEK's product portfolio is rich and diversified, designed to meet the complex needs of its clientele across different industries. Below is a detailed outline of its offerings divided into its two main segments:

- Electronic Instruments Group (EIG)

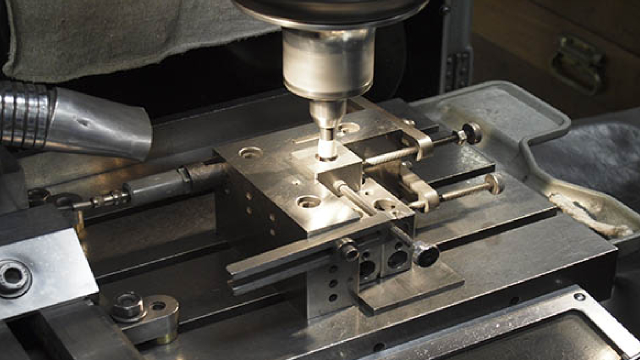

This segment emphasizes advanced instrument solutions tailored for the process, aerospace, power, and industrial markets. Products range from process and analytical instruments targeting oil and gas, petrochemical, pharmaceutical, semiconductor, automation, and food and beverage industries, to specialized equipment for laboratory, ultra-precision manufacturing, medical, and test and measurement fields. It also covers power quality monitoring devices, uninterruptible power supplies, electromagnetic compatibility test equipment, gas turbines sensors, heavy trucks dashboard instruments, and data acquisition systems for aerospace and defense.

- Electromechanical Group (EMG)

EMG expands AMETEK's offerings into engineered medical components, automation solutions, thermal management systems, specialty metals, and electrical interconnects. This includes single-use surgical instruments, implantable components, drug delivery systems, engineered electrical connectors, and electronics packaging. Additionally, it provides precision motion control products, high-purity powdered metals, specialty clad metals, metal matrix composites, motor-blower systems for thermal management, and motors for commercial appliances. The segment also oversees a network of aviation maintenance, repair, and overhaul facilities, ensuring high-quality service in the aerospace sector.