Fastenal Company (FAS)

Summary

FAS Chart

Fastenal (FAST) Reliance on International Sales: What Investors Need to Know

Explore how Fastenal's (FAST) revenue from international markets is changing and the resulting impact on Wall Street's predictions and the stock's prospects.

Embedded, Efficient, And Expensive: Fastenal's Growth Story With A Premium Tag

Fastenal delivered strong Q2 results, driven by big-ticket customer growth, market share gains, and expanding digital sales footprint. Operating leverage from its digital solutions is boosting margins and keeping SG&A growth in check. Risks include a slowdown in new FMI device signings and elevated inventory.

Fastenal Surges After Earnings Beat, Tariff Risks Loom

Fastenal Co. NASDAQ: FAST stock is up more than 4.5% in early trading after the company reported a double-beat in its second quarter earnings report. The company delivered a slight beat on both the top and bottom lines.

Fastenal Company Dividends

FAS 26 Jul 2024 | Other | €0.39 Per Share |

FAS 24 Apr 2024 | Other | €0.39 Per Share |

FAS 31 Jan 2024 | Other | €0.39 Per Share |

FAS 5 Dec 2023 | Other | €0.38 Per Share |

FAS 25 Oct 2023 | Other | €0.35 Per Share |

Fastenal Company Earnings

| 13 Oct 2025 (In 2 months) Date | | 0.3 Cons. EPS | - EPS |

| 14 Jul 2025 Date | | 0.28 Cons. EPS | - EPS |

| 11 Apr 2025 Date | | - Cons. EPS | - EPS |

| 16 Jan 2025 Date | | - Cons. EPS | - EPS |

| 11 Oct 2024 Date | | - Cons. EPS | - EPS |

FAS 26 Jul 2024 | Other | €0.39 Per Share |

FAS 24 Apr 2024 | Other | €0.39 Per Share |

FAS 31 Jan 2024 | Other | €0.39 Per Share |

FAS 5 Dec 2023 | Other | €0.38 Per Share |

FAS 25 Oct 2023 | Other | €0.35 Per Share |

| 13 Oct 2025 (In 2 months) Date | | 0.3 Cons. EPS | - EPS |

| 14 Jul 2025 Date | | 0.28 Cons. EPS | - EPS |

| 11 Apr 2025 Date | | - Cons. EPS | - EPS |

| 16 Jan 2025 Date | | - Cons. EPS | - EPS |

| 11 Oct 2024 Date | | - Cons. EPS | - EPS |

Fastenal Company (FAS) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

What is the earnings per share?

When is the next earnings date?

Has Fastenal Company ever had a stock split?

Fastenal Company Profile

| Industrial - Distribution Industry | Industrials Sector | Daniel L. Florness CEO | XBER Exchange | US3119001044 ISIN |

| US Country | 21,339 Employees | 29 Jul 2025 Last Dividend | 23 May 2019 Last Split | 26 Mar 1990 IPO Date |

Overview

Founded in 1967 and headquartered in Winona, Minnesota, Fastenal Company operates as a major player in the wholesale distribution of industrial and construction supplies both domestically and internationally. With a broad market base, Fastenal caters to the United States, Canada, Mexico, and beyond in North America, serving various sectors including manufacturing, non-residential construction, maintenance, repair, operations, and even governmental entities. Fastenal has grown substantially over the years, becoming synonymous with not just fasteners but a wide range of construction and industrial supplies. The company prides itself on its ability to provide essential components across multiple industries, ensuring reliability and efficiency in operations and projects.

Products and Services

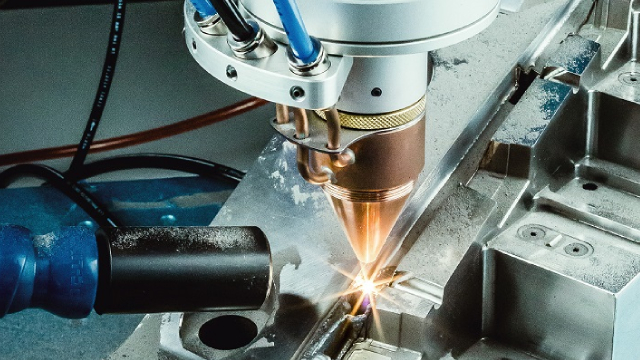

Fastenal Company’s product lineup is expansive, covering essential supplies for construction, manufacturing, and maintenance. Below are some of their key offerings:

- Threaded Fasteners: This includes a comprehensive range of bolts, nuts, screws, and studs. These items are crucial in various manufacturing products and construction projects, acting as fundamental components that hold materials together.

- Related Washers: Accompanying the threaded fasteners, Fastenal provides related washers that help distribute the load of a screw or nut, preventing damage to surfaces and ensuring a secure hold.

- Miscellaneous Supplies and Hardware: Beyond fasteners, Fastenal offers a variety of other essential products such as pins, machinery keys, and concrete anchors. These items find use in numerous applications across the construction and manufacturing industries.

- Metal Framing Systems: Offering solutions for structural support, Fastenal's metal framing systems are vital for non-residential construction projects, providing stability and flexibility in design and structure.

- Wire Ropes and Strut Products: These products are critical in construction and various industrial applications, providing support and strength where needed. Wire ropes are essential for lifting and rigging, while strut products offer structural support for conduits and piping.

- Rivets and Related Accessories: Fastenal supplies rivets and a range of accessories, serving as permanent mechanical fasteners before and after installation, crucial for many manufacturing and repair tasks.

The company's vast product range serves a wide array of markets, including original equipment manufacturers (OEMs), maintenance, repair, operations (MRO) customers, the non-residential construction market, and sectors like agriculture, transportation, mining, education, retail, and energy. Fastenal also caters to governmental bodies at various levels, fulfilling their needs for robust, efficient, and reliable industrial and construction supplies.