PayPal Holdings Inc. (PYPL)

PayPal: The Bank Charter Changes Things, But I Still Remain Bullish

PayPal Holdings, Inc.'s recent application for a bank charter directly contradicts the asset-light argument that underpinned my September upgrade—I analyze whether this strategic pivot breaks the bullish case. While the market fears balance sheet risk, securing an ILC charter would allow PYPL to capture a funding cost arbitrage on SMB loans that could structurally reset operating margins higher. The Apple Playbook of aggressive capital returns now faces a major hurdle. I detail how new regulatory capital requirements will impact the pace of PYPL share buybacks and short-term ROE.

PayPal's Big Step: Is the Launch of PayPal Bank a Game Changer?

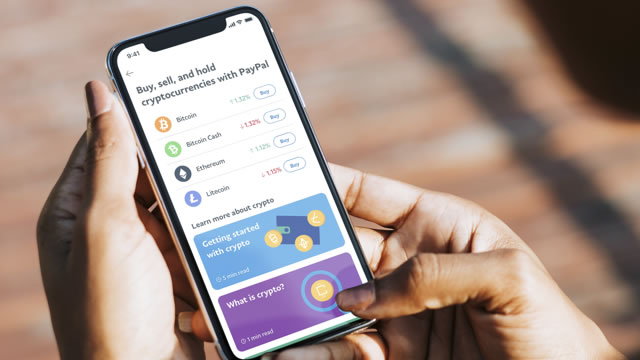

PYPL files an application to launch PayPal Bank, aiming to boost small-business lending and cut third-party reliance, and, if approved, add FDIC-insured customer deposits.

PayPal plans to launch bank serving small businesses around the US

PayPal files with Utah and the FDIC to launch PayPal Bank, an industrial loan company offering small business lending and FDIC-insured savings accounts.

PayPal applies for US banking charter to expand lending and deposit services

PayPal Holdings Inc (NASDAQ:PYPL, XETRA:2PP) announced that it has filed applications with the Utah Department of Financial Institutions and the Federal Deposit Insurance Corporation (FDIC) to establish a Utah-chartered industrial loan company, potentially creating PayPal Bank. The move represents a shift from PayPal's traditional payments focus toward offering more comprehensive banking services, including small-business lending and interest-bearing deposit accounts.

PayPal Holdings Continues To Be Underappreciated

PayPal Holdings remains a "Strong Buy," combining robust growth, rising profitability, and ongoing innovation at an absolute valuation I find compelling. PYPL's strategic shift away from low-margin PSP transactions is boosting core transaction growth and deepening engagement among valuable customers. Venmo and Buy Now, Pay Later ("BNPL") offerings are driving double-digit payment volume and user growth, reinforcing PYPL's competitive moat.

Paypal (PYPL) Sees a More Significant Dip Than Broader Market: Some Facts to Know

Paypal (PYPL) reached $60.74 at the closing of the latest trading day, reflecting a -1.49% change compared to its last close.

PayPal Deepens Small Business Lending Push With PayPal Bank

PayPal said it is ready to venture deeper into small business lending. The company applied to the Utah Department of Financial Institutions and the Federal Deposit Insurance Corp. to create PayPal Bank, a proposed Utah-chartered industrial loan company, according to a Monday (Dec. 15) press release provided to PYMNTS.

Fintech Stocks are a Compelling Long-Term Bet for Sustainable Returns

Fintech gains momentum as StoneCo, Block and PayPal reshape payments, lending and banking, drawing investors to fast-growing digital finance platforms.

PayPal downgraded by BofA as branded checkout turnaround stalls

Bank of America on Thursday downgraded PayPal Holdings Inc (NASDAQ:PYPL, XETRA:2PP) to “Neutral,” warning that the company's effort to revive growth in its core branded checkout business is taking longer than expected and that 2026 is shaping up to be an investment-heavy year. Analysts said the firm is stepping to the sidelines until there is clearer evidence that PayPal's turnaround is gaining traction.

PayPal's Ecosystem Expansion: Will Partnerships Boost Profitability?

PYPL expands its ecosystem through new partnerships across major platforms to boost seamless commerce.

PayPal: Writing It Off Could Be A Grave Mistake (Rating Upgrade)

I double upgrade PayPal to a buy, citing overlooked long-term growth initiatives and a deeply discounted forward P/E near 11.5. PYPL is gaining traction in BNPL and Venmo, while innovating in agentic AI and optimizing legacy PSP for profitability. Despite sluggish near-term growth and FY2025 guidance, resilience in transaction activity and cash flow supports a constructive long-term view.

PayPal Holdings, Inc. (PYPL) Is a Trending Stock: Facts to Know Before Betting on It

Paypal (PYPL) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.