Stock Market & Financial News

2 Capital Efficient Stocks to Buy on the Dip: AEM, FIX

Most supportive of the notion that the incredible performances of these highly ranked stocks will eventually continue is their capital efficiency.

CVB Financial Corp. (CVBF) M&A Call Transcript

CVB Financial Corp. (CVBF) M&A Call Transcript

Phillips Edison & Company, Inc. (PECO) Discusses Long-Term Growth Strategy and Performance in Grocery-Anchored Retail Transcript

Phillips Edison & Company, Inc. (PECO) Discusses Long-Term Growth Strategy and Performance in Grocery-Anchored Retail Transcript

Newcore Gold Ltd. (NCAU:CA) Discusses Exploration Update and Development Progress at Enchi Project in Ghana Transcript

Newcore Gold Ltd. (NCAU:CA) Discusses Exploration Update and Development Progress at Enchi Project in Ghana Transcript

Capricor Therapeutics, Inc. (CAPR) Discusses HOPE-3 Phase III Trial Results and Regulatory Path for Duchenne Muscular Dystrophy Therapy Transcript

Capricor Therapeutics, Inc. (CAPR) Discusses HOPE-3 Phase III Trial Results and Regulatory Path for Duchenne Muscular Dystrophy Therapy Transcript

Elliott Builds Over $1 Billion Stake in Lululemon

The activist investor is pushing for former Ralph Lauren executive Jane Nielsen to be Lululemon's new CEO.

Adobe hit with proposed class-action, accused of misusing authors' work in AI training

Like pretty much every other tech company in existence, Adobe has leaned heavily into AI over the past several years. The software firm has launched a number of different AI services since 2023, including Firefly—its AI-powered media-generation suite.

DoorDash joins Instacart in the newest shopping battleground — ChatGPT

DoorDash Inc. on Wednesday said it had joined forces with OpenAI to allow people to shop for groceries in ChatGPT and check out on the delivery platform itself, as artificial intelligence becomes a bigger competitive front for online shopping.

Bank Of Montreal: Upside Potential Is Limited, But A Great Dividend Play

Bank of Montreal maintains robust fundamentals, prudent asset diversification, and disciplined loan management amid inflationary and policy easing headwinds. BMO's valuation remains reasonable, although the stock appears nearly fully valued, limiting upside potential; stable dividends and decent yields remain attractive. Technical indicators show bullish momentum, though caution is warranted due to potential overbuying and neutral market sentiment signals.

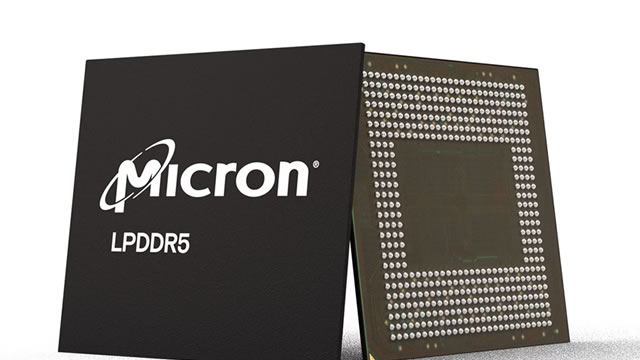

Micron (MU) Reports Q1 Earnings: What Key Metrics Have to Say

Although the revenue and EPS for Micron (MU) give a sense of how its business performed in the quarter ended November 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Apple's ATT leads to significant revenue losses for SMEs

Apple's data protection measure "App Tracking Transparency" (ATT) strengthens user privacy, but causes significant revenue losses in e-commerce, especially for small and medium-sized enterprises (SMEs). The reason for this is the mandatory opt-in for users introduced by ATT.

Shares in South Korea's LGES drop more than 7% after Ford cancels EV battery deal

Shares of LG Energy Solution dropped as much as 7.6% in morning trade on Thursday after the company announced a day earlier that Ford Motor had cancelled an electric vehicle (EV) battery supply deal.

Micron Post Earnings: Just How Good Could Things Get?

Micron Technology, Inc. is one of the few companies walking the talk on AI, guiding for adjusted profit to almost double sequentially from $4.78 to $8.42 and $4-5B top-line upside in Q2. Everyone knows that MU is extremely well-positioned due to the memory-bound nature of AI build-out, but we don't think markets recognize that Micron has more leverage in the bank. Unlike Nvidia and Broadcom, Micron just reported a gross margin of 56.8%, up from 45.7% last quarter, and is guiding for 68% next quarter, with more growth expected in FY26.

Sirius XM (SIRI) Increases Despite Market Slip: Here's What You Need to Know

Sirius XM (SIRI) closed the most recent trading day at $21.75, moving +1.21% from the previous trading session.

Astera Labs, Inc. (ALAB) Registers a Bigger Fall Than the Market: Important Facts to Note

In the most recent trading session, Astera Labs, Inc. (ALAB) closed at $140.24, indicating a -3.24% shift from the previous trading day.

Trane Technologies (TT) Registers a Bigger Fall Than the Market: Important Facts to Note

Trane Technologies (TT) concluded the recent trading session at $382.3, signifying a -3.45% move from its prior day's close.

Here's Why NXP Semiconductors (NXPI) Fell More Than Broader Market

In the latest trading session, NXP Semiconductors (NXPI) closed at $223.23, marking a -2.84% move from the previous day.

D.R. Horton (DHI) Suffers a Larger Drop Than the General Market: Key Insights

In the closing of the recent trading day, D.R. Horton (DHI) stood at $152, denoting a -2.01% move from the preceding trading day.

Steel Dynamics (STLD) Rises As Market Takes a Dip: Key Facts

Steel Dynamics (STLD) concluded the recent trading session at $172.74, signifying a +2.13% move from its prior day's close.

Markets Sell Off -0.5% to -1.8% Ahead of Inflation Rate Thursday

This marks the fourth-straight down-day for the blue-chip Dow and the comprehensive S&P 500.

Exclusive: Amazon, Walmart shareholder pushes firms to report impact of Trump's immigration policies

A union-aligned investment group sent letters to Amazon, Walmart and Alphabet on Wednesday, asking how U.S. President Donald Trump's immigration policies were impacting their finances and supply chains, according to the documents seen by Reuters.

Google, Amazon and Meta Embed AI Into Core Products

Big Tech's artificial intelligence (AI) push is accelerating on multiple fronts, from productivity agents embedded in everyday software to deeper bets on infrastructure, content and consumer hardware.

FTC probing Instacart's AI pricing tool after being caught charging customers different prices: report

"We are disturbed by what we have read in the press about Instacart's alleged pricing practices," the FTC said in a statement.

Alaska Air Group (ALK) Sees a More Significant Dip Than Broader Market: Some Facts to Know

In the most recent trading session, Alaska Air Group (ALK) closed at $51.24, indicating a -2.25% shift from the previous trading day.

Archer Daniels Midland (ADM) Increases Despite Market Slip: Here's What You Need to Know

Archer Daniels Midland (ADM) closed at $58.56 in the latest trading session, marking a +1% move from the prior day.

BP (BP) Ascends While Market Falls: Some Facts to Note

BP (BP) closed at $34.47 in the latest trading session, marking a +2.1% move from the prior day.

Boston Scientific (BSX) Advances While Market Declines: Some Information for Investors

Boston Scientific (BSX) reached $94.48 at the closing of the latest trading day, reflecting a +1.65% change compared to its last close.

Badger Meter (BMI) Registers a Bigger Fall Than the Market: Important Facts to Note

In the closing of the recent trading day, Badger Meter (BMI) stood at $180.87, denoting a -1.72% move from the preceding trading day.

United Airlines (UAL) Declines More Than Market: Some Information for Investors

In the latest trading session, United Airlines (UAL) closed at $110.27, marking a -1.96% move from the previous day.

Snap (SNAP) Increases Despite Market Slip: Here's What You Need to Know

The latest trading day saw Snap (SNAP) settling at $7.5, representing a +1.76% change from its previous close.